If you are a business owner, you have probably heard the term “break-even point” at some stage. But what does this actually mean and why is it so important?

In simple terms, break-even is the point at which your business has covered all fixed expenses and starts to make a profit. This number can be expressed as a dollar amount or number of sales.

First, calculate these two numbers

There are two numbers you need to be able to calculate your breakeven:

1. Your fixed costs. Fixed costs are those expenses that don’t change regardless of how many sales you generate. For example, rent, electricity, internet, phone, insurance, support staff salaries. They are consistent and easy to calculate.

2. Your gross profit margin. Your gross profit is calculated by deducting variable costs from sales. Variable costs change depending on the volume of sales, for example, sales commissions, franchise fees, product costs. Gross profit margin as a percentage is calculated by dividing the gross profit amount by total sales.

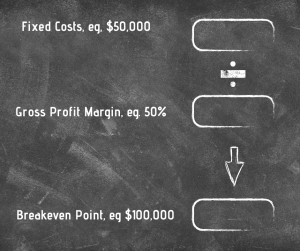

Break-Even Formula:

Lets step through an example:

If your business has fixed expenses of $50,000 per month (including partner’s salary)

Let’s say the business makes a contribution margin on every sale of 50%

The breakeven point for the business is $50,000 / 50%

Break-even sales per month = $100,000

The business needs to generate $100,000 per month in sales to cover costs. Knowing this number breaks it down into simple terms so you know the minimum you need to do to make a profit.

Now you know the number, what does it mean?

The lower your breakeven, the lower the risk and the lower the number of sales you need to make to start generating a profit. If you have clients on fixed monthly fees, even better, because you have a consistent source of monthly income.

There are strategies you can use to reduce your break-even point such as:

- Reducing fixed costs

- Improving gross profit margin

- Changing the sales mix to sell more products or services with a higher contribution margin

- Increasing sales prices (as long as this doesn’t impact sales volume significantly)

It’s also important to know where your leads are coming from, so you know where to invest your marketing budget. To get this information, you need to ensure your CRM (Customer Relationship Management) is kept up to date and all information entered. If you don’t have a CRM, it doesn’t matter, as long as you keep a record of the source of new customers.

Owner’s salary

It is a good idea to include the monthly salary of the business owner in this calculation and make sure that the salary is enough to cover a satisfactory lifestyle. If you are not sure what you need to cover your lifestyle, you will need to calculate this amount. There are many online tools available to assist with this such as the Money Smart Budget Planner, or you can just use a spreadsheet. It doesn’t matter as long as you have an honest look at your spending. It’s not a fun process. I know, I have done it myself, but it really helps to have a good idea of what your living costs are.

To use the previous example, if you make more than $100,000 sales in a month, you know that you are:

- Meeting fixed costs

- Paying a salary to the owner to support a comfortable lifestyle

- Generating surplus profit

If your sales numbers are over your break-even amount, you know that you have excess profits that you can use to reinvest back into the business for growth, hire new employees or increase your standard of living.

If you can stick to your monthly salary, this can also help with these calculations. While the company bank account may still be your money and it is tempting to dip in to pay for personal expenses, it can be helpful to stick to a regular monthly salary and only draw out additional funds when you know there are profits to distribute from.

Review Regularly

If circumstances change, you will need to review these calculations and update as needed. The calculation should be done at least annually, if not more frequently.

Need help calculating your Break-Even amount?

If you need help calculating and monitoring your break-even or help with some strategies to reduce your breakeven, please get in touch. We can schedule a complimentary Strategy Session to discuss your business, the current opportunities and challenges and the next steps you should take now to take your business to the next level.

We are 100% virtual. However, if you would prefer an onsite visit, we service the areas of Albury, Wodonga, Griffith, Leeton and Wagga.